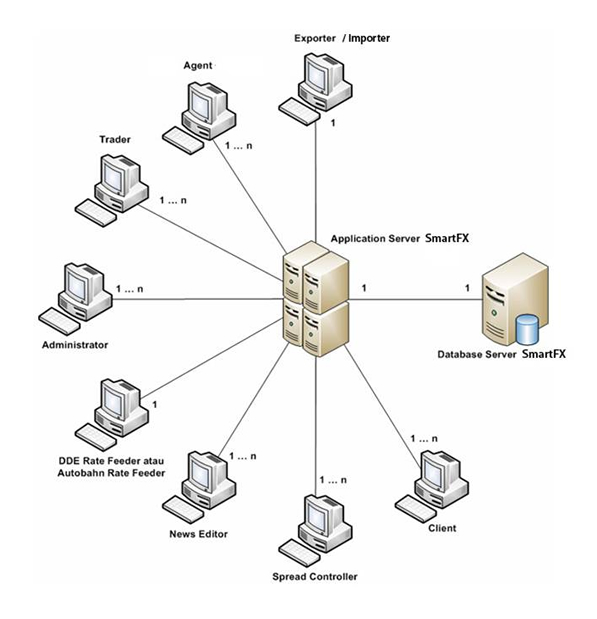

Feature Overview

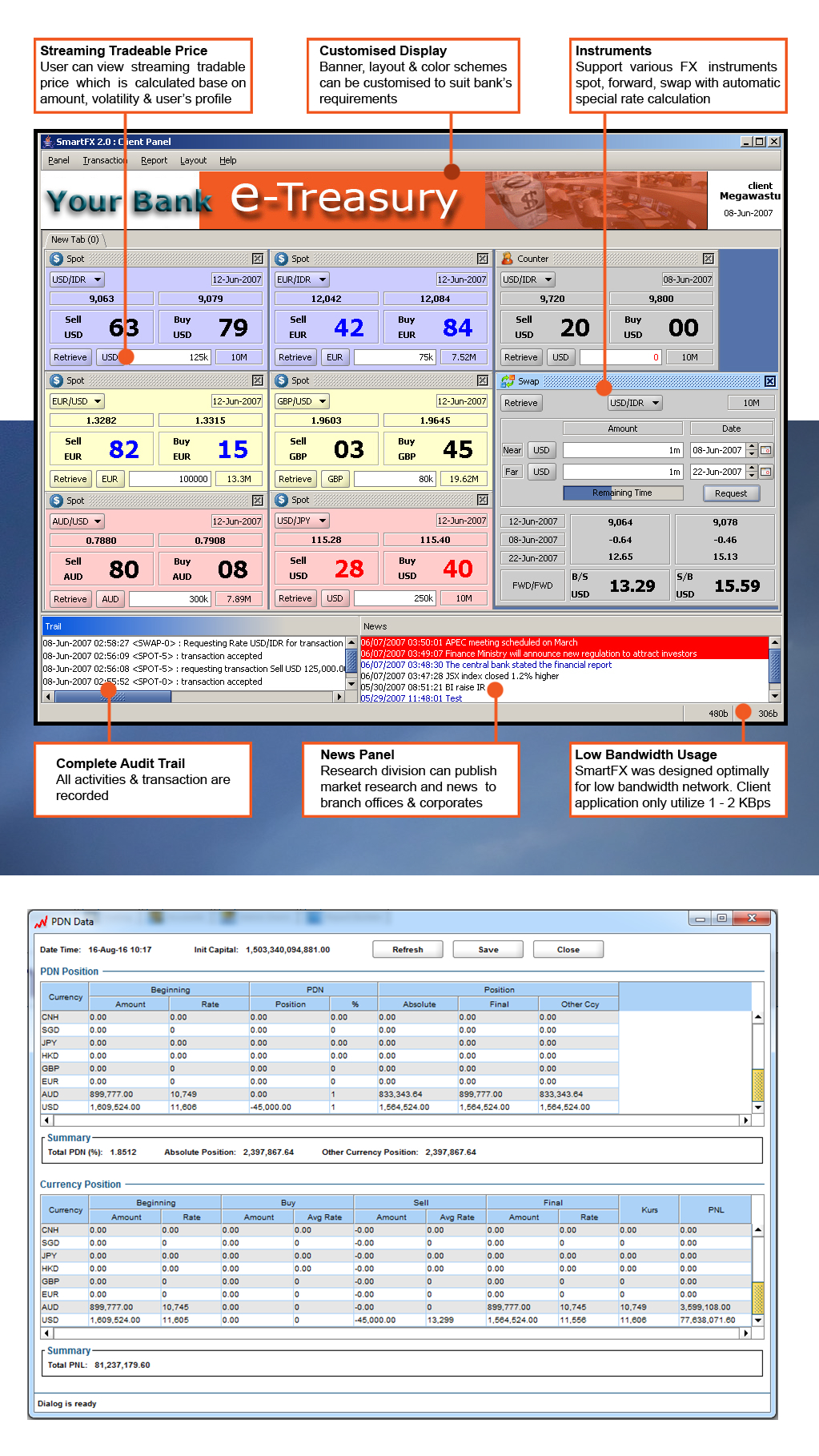

- Automated FX Dealing System

- Manual Pricing for Transaction Exceeds Specific Amount

- Real-time Special Rate Pricing Engine

- Flexible Pricing Engine with configurable margin formula

- Position and P/L monitoring (Blotter)

- Electronic trade confirmation /ticket

- Risk Management / Limit

- Research & News Distribution

- Advanced Reporting and Executive Summary

- Datafeed Source Options: Citigroup FX eCommerce FIX infrastructure, Bloomberg, and Reuter.

- Flexible Interface Format: Adapt to existing application & mechanism: XML, TXT, CSV, Excel etc; Adapter to middleware; Interface to Treasury System; Interface to Core Banking System

Advantages

Improve Efficiency

- Self motivated – Provide flexibility for Branches to adjust MU and can track their own profitability.

- Automation – Low Value / Large Volume transactions can be auto-traded.

- Empowered – Raised branch trading limit as prices are margin adjusted anyway.

- Reduce Opportunity Loss – all calls to treasury & branches can now be picked up online.

Reduce Operational Risk

- Credit limit check – all trades are credit checked.

- STP of all transactions.

Reduce Transaction Cost

- All transaction details are inputted at source; reduce processing error.

- STP to Treasury Systems for Position Keeping, Settlement & Accounting.

- Scalability – possible to handle multiple growth in term of transaction volume.

- Reduce Telephone / fax cost.

Corporate Image

- Standard price for all branches.

- Provide a new sales channel for Treasury Business.

- Differentiate the service.

- Better service experience – client are not kept waiting.